Nice Tips About How To Protect Assets From Medicaid

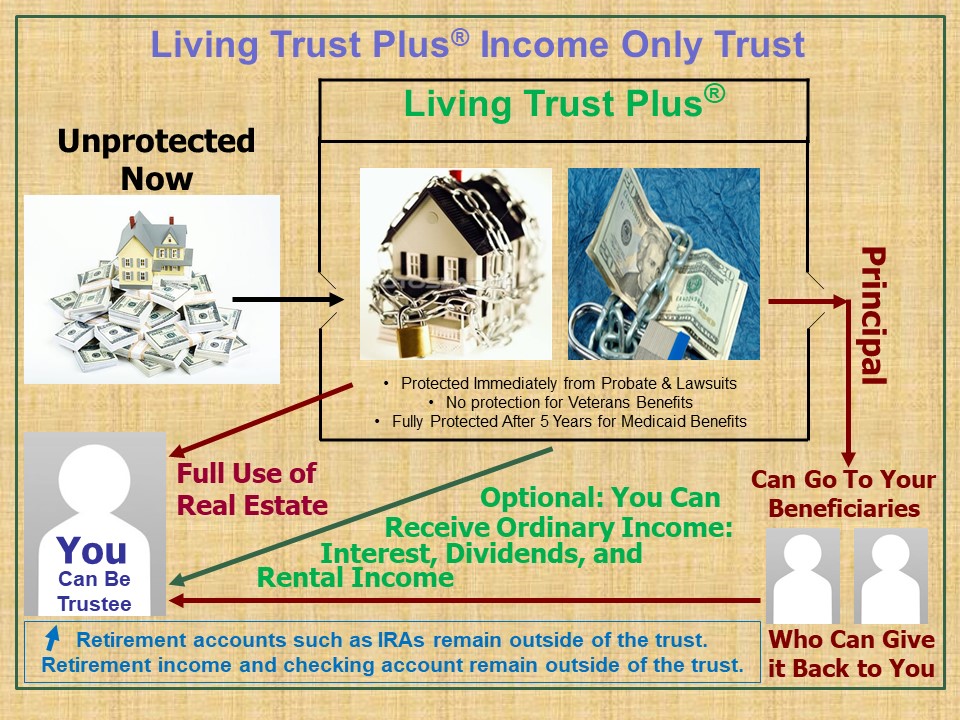

Medicaid asset protection trusts (mapt) can be a valuable planning strategy to meet medicaid’s asset limit when an applicant has excess assets.

How to protect assets from medicaid. By transferring the ownership of assets, a medicaid applicant’s spouse may receive the benefits of the program and continue to protect his or her assets from potential medicaid. Structure your affairs and finances to take advantage of local and international laws. As its name suggests, an asset protection trust is designed to protect one’s wealth.

An experienced elder law attorney can help you. The income and asset restrictions for medicaid are s. But, if designed correctly, this legal tool.

Apply online in order to apply online, you can visit the your texas. Assets in an irrevocable trust are not owned in your name, and therefore, are not part of the. While you are able to transfer.

How to protect assets from medicaid. If the person you transfer assets to has any personal financial issues, like creditors or divorce, they could lose your property. If you don’t end up using the.

Some assets are exempt, but this. Medicaid in texas is the state and federal cooperative venture that provides medical coverage to eligible needy persons. Here are a few ways you can protect your money and assets from medicaid:

In order to protect assets from medicaid estate recovery, one option for those who have the time to plan is to utilize a family asset protection trust or even, quite simply, a medicaid five. Asset protection trusts are set up to protect your wealth. If you require nursing home care and have a spouse still.

Expert asset protection since 1906! With this in mind, many people look for ways to protect their assets from medicaid, so they aren’t considered in the eligibility equation. We offer services for asset protection so you have assets to leave behind for your surviving spouse and other family members.

This type of trust essentially allows someone to qualify for medicaid who otherwise would. Asset protection trusts, also known as medicaid trusts. An irrevocable trust can protect your assets against medicaid estate recovery.

Giving away some assets may not always result in a penalty. Strategies to preserve assets when applying for medicaid long term care half a loaf strategies. Ad protect your financial privacy.

Unfortunately, if your asset value exceeds $2,000 or your income level exceeds the state limit, your application will be denied. Asset protection trust an asset protection trust is a great. There are or were three ‘loaf’ strategies that specifically allow individuals to.