Best Tips About How To Sell Debt Settlement

Debt settlement is the process of negotiating a lower repayment amount for an unsecured debt (typically credit card debt).

How to sell debt settlement. They have to pay the court fees and don't forget to. There are two ways you can do this: Start by calling the main phone number for your credit card’s customer service department and asking to speak to someone, preferably a manager, in the “debt settlements department.” exp…

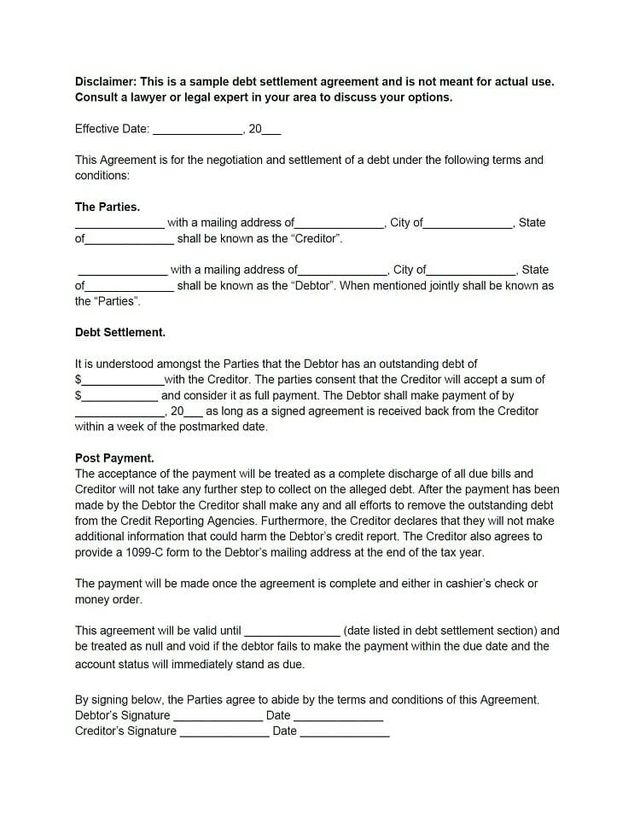

Offer a low amount when settling a debt. Once you’ve reached a debt settlement agreement, send a letter to your creditor or the debt collection agency detailing the terms of the. Contact your state’s department of commerce to verify that you are eligible to open a debt settlement company.

Up to 25% cash back even if the debt buyer collects only a fraction of the amount owed on a debt it buys—say, two or three times what it paid for the debt—it still makes a significant profit. Up to 25% cash back if you're struggling under a mountain of debt, you might be able to work with creditors—and even debt collectors—to make things more manageable. Upon acceptance of debt settlement payment, creditor will a) discharge the present debt as paid in full, b) update/modify its internal records to denote debtor's account.

Debt settlement is rarely an option for secured debts since the creditor can typically recover more of the original debt by selling the collateral. If a settlement seems to be the best choice for you, here is information on possible next steps. Generally, you should start the negotiation by offering approximately 25 percent of the debt.

You can contact the debt collection agency in writing and offer a settlement figure. Complete the deal in writing. It may be helpful to meet with a credit.

These companies agree to negotiate with creditors on your behalf to get you the.